The Consumer Price Index (CPI) is a crucial economic indicator that helps track changes in the price level of a basket of goods and services over time. Understanding the CPI is essential for anyone interested in economic trends, inflation, and the overall health of an economy. This beginner’s guide will provide an overview of the CPI, its purpose, history, components, and its impact on the economy and everyday life.

Introduction to CPI

Definition of CPI

The Consumer Price Index (CPI) is a measure that examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food, and medical care. It is calculated by taking price changes for each item in the predetermined basket of goods and averaging them. Prices are collected periodically, typically monthly, to monitor inflation and cost of living. According to the U.S. Bureau of Labor Statistics (BLS), the CPI is a key indicator of inflation (source: U.S. BLS).

Purpose of CPI

The CPI serves several important purposes:

- Measuring Inflation: The primary use of the CPI is to measure inflation. By comparing the current price index to the index from a previous period, economists can determine the rate at which prices are rising or falling. According to the International Monetary Fund (IMF), inflation tracking is crucial for economic stability (source: IMF).

- Economic Indicator: It is a vital economic indicator used by policymakers, economists, and researchers to gauge the health of the economy. The Federal Reserve relies on CPI data to inform monetary policy decisions (source: Federal Reserve).

- Indexing Financial Instruments: The CPI is used to adjust the value of wages, pensions, and other financial instruments to maintain purchasing power.

History and Development of CPI

Early Beginnings

The concept of tracking prices dates back to ancient times, but the modern CPI has its roots in the early 20th century. Initially, price indexes were used to adjust wages and benefits during periods of economic turmoil. The first official CPI in the United States was introduced in 1919 by the BLS to monitor inflation post-World War I (source: U.S. BLS).

Evolution of the CPI

The CPI as we know it today has evolved significantly. In the UK, the first official CPI was introduced in the 1940s to monitor inflation and adjust wages. Over the years, the methodology for calculating the CPI has been refined to improve accuracy and representation. According to the Office for National Statistics (ONS), the CPI has undergone several revisions to better reflect consumer behaviour and spending patterns (source: ONS).

Components of the Consumer Price Index

The CPI Basket

The CPI is based on a basket of goods and services that represents the typical consumption patterns of households. This basket includes:

- Food and Beverages: Groceries, dining out, alcoholic and non-alcoholic beverages.

- Housing: Rent, utilities, home maintenance, and repairs.

- Apparel: Clothing, footwear, and accessories.

- Transportation: Vehicle purchase, fuel, public transportation.

- Medical Care: Health insurance, medical services, medications.

- Recreation: Entertainment, hobbies, and recreational activities.

- Education and Communication: Tuition fees, books, communication services.

- Other Goods and Services: Personal care products, insurance, and miscellaneous expenses.

Weighting of Components

Each category in the CPI basket is assigned a weight based on its relative importance in the average consumer’s budget. For example, housing typically has a higher weight than apparel because households spend a larger portion of their income on housing. The BLS conducts extensive surveys to determine these weights (source: U.S. BLS).

How Consumer Price Index (CPI) is Calculated

Data Collection

The calculation of the CPI involves collecting price data for the items in the CPI basket. This data is gathered from various sources, including:

- Retail Stores: Prices of goods and services are collected from a sample of retail stores across different regions.

- Service Providers: Prices for services like medical care, education, and transportation are collected from relevant service providers.

- Surveys: Consumer expenditure surveys help determine the weight of each item in the CPI basket.

Calculation Method

The CPI is calculated using the following steps:

- Price Collection: Gather prices for all items in the CPI basket.

- Price Comparison: Compare the current prices to those in a base period.

- Weighted Average: Calculate the weighted average of price changes for all items.

- Index Calculation: Compute the index by comparing the current weighted average to the base period’s weighted average.

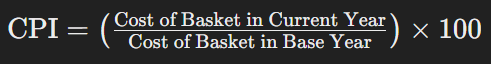

The formula for the CPI is:

Impact of CPI on the Economy

Measuring Inflation

The CPI is a key measure of inflation, which is the rate at which the general level of prices for goods and services is rising. Policymakers, such as central banks, use the CPI to set monetary policy. For instance, if the CPI indicates high inflation, a central bank may increase interest rates to cool down the economy. According to the European Central Bank (ECB), CPI data is critical for maintaining price stability (source: ECB).

Wage and Pension Adjustments

CPI is often used to adjust wages, pensions, and other forms of income to maintain purchasing power. This practice, known as indexation, ensures that income keeps up with rising prices, protecting consumers from the eroding effects of inflation.

Policy Formulation

Government agencies use CPI data to formulate economic policies. For example, social security benefits and tax brackets may be adjusted based on CPI to ensure that benefits and taxes reflect current economic conditions.

Interpretation of CPI Data

Understanding CPI Changes

CPI data is usually reported as a percentage change from a previous period. For instance, a CPI increase of 2% over the previous year indicates that, on average, prices have risen by 2%.

Core CPI

Economists often look at the Core CPI, which excludes volatile items such as food and energy prices. Core CPI provides a clearer view of underlying inflation trends by eliminating the impact of temporary price shocks.

CPI vs. RPI

In the UK, the Retail Price Index (RPI) is another measure of inflation. While similar to CPI, RPI includes housing costs such as mortgage interest payments, making it slightly different. The CPI is generally preferred for policy purposes because it aligns with international standards.

Limitations of the CPI

Representation Issues

The consumer price index may not accurately reflect the cost of living for all households. Different households have different spending patterns, and the CPI basket may not represent everyone’s consumption habits. For instance, retirees may spend more on healthcare than the average household. According to a report by the Brookings Institution, these representation issues can lead to policy missteps (source: Brookings Institution).

Quality Changes

Changes in the quality of goods and services can affect the CPI. For example, a new smartphone may have more features than an older model, which can complicate price comparisons.

Substitution Bias

The CPI assumes a fixed basket of goods, which may not account for consumer substitution. If the price of an item rises significantly, consumers might switch to a cheaper alternative, but the CPI does not fully capture this behavior.

Conclusion

The Consumer Price Index (CPI) is a vital economic indicator that helps measure inflation and the cost of living. By understanding what the CPI is, how it is calculated, and its impact on the economy, consumers, policymakers, and businesses can make informed decisions. While the CPI has its limitations, it remains an essential tool for monitoring economic health and formulating economic policies.

Leave a comment