The UK stock market is home to several key indices that serve as barometers of market performance and economic health. Among the most prominent are the FTSE 100, FTSE 250, and FTSE All-Share indices. These indices provide insights into the movements and trends of the market, helping investors make informed decisions. This article explores the characteristics, composition, and significance of these key indices.

Introduction to Stock Market Indices

What is a Stock Market Index?

A stock market index is a statistical measure that reflects the composite value of a selected group of stocks. Indices are used to track the performance of specific segments of the stock market, such as large-cap companies, mid-cap companies, or the entire market. They serve as benchmarks for comparing individual stock performance and overall market trends.

Importance of Stock Market Indices

Stock market indices are crucial tools for investors, analysts, and policymakers. They help in:

- Tracking Market Performance: Indices provide a snapshot of how the market is performing, indicating whether it is trending upward or downward.

- Benchmarking: Investors use indices as benchmarks to evaluate the performance of their portfolios against the market.

- Economic Indicators: Indices can signal economic trends and investor sentiment, offering insights into the broader economy.

FTSE 100

Overview

The FTSE 100, often referred to simply as the “Footsie,” is the most widely recognized index in the UK. It represents the 100 largest companies listed on the London Stock Exchange (LSE) by market capitalization.

Composition

The FTSE 100 includes companies from various sectors, including finance, energy, consumer goods, and healthcare. Some of the well-known constituents include BP, HSBC, and Unilever. The composition of the FTSE 100 is reviewed quarterly to ensure it accurately reflects the largest companies on the LSE.

Calculation

The FTSE 100 is a market-capitalization-weighted index, meaning that companies with larger market capitalizations have a greater influence on the index’s performance. The formula for calculating the index is:

The divisor is adjusted to maintain the continuity of the index over time.

Significance

The FTSE 100 is a key indicator of the health of the UK economy and investor sentiment. It is closely watched by investors, analysts, and policymakers to gauge market trends and economic performance. Due to its focus on large-cap companies, the FTSE 100 is often seen as a reflection of the performance of multinational corporations and their global operations.

FTSE 250

Overview

The FTSE 250 index comprises the next 250 largest companies listed on the LSE after the FTSE 100. It represents mid-cap companies that are generally more domestically focused compared to the multinational corporations in the FTSE 100.

Composition

The FTSE 250 includes a diverse range of companies from various sectors, such as industrials, consumer services, and technology. Companies like Greggs, JD Sports, and Howden Joinery are examples of constituents. Like the FTSE 100, the composition of the FTSE 250 is reviewed quarterly.

Calculation

The FTSE 250 is also a market-capitalization-weighted index. The same formula used for the FTSE 100 applies here:

Significance

The FTSE 250 is considered a more accurate reflection of the UK economy compared to the FTSE 100, as it includes a higher proportion of domestic companies. It is often viewed as a barometer of the performance of mid-sized businesses and the broader economic environment in the UK. The index is popular among investors seeking exposure to growth opportunities within the UK.

FTSE All-Share

Overview

The FTSE All-Share index provides a comprehensive view of the performance of the UK stock market. It includes almost all companies listed on the Main Market of the LSE, making it a broad-based measure of the market.

Composition

The FTSE All-Share is composed of approximately 600 companies, encompassing the constituents of the FTSE 100, FTSE 250, and FTSE SmallCap indices. This broad coverage ensures that the FTSE All-Share reflects the performance of large, mid, and small-cap companies across various sectors.

Calculation

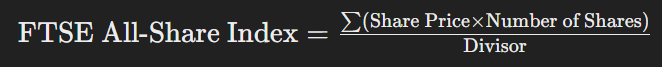

The FTSE All-Share is a market-capitalization-weighted index, calculated using the same methodology as the FTSE 100 and FTSE 250:

Significance

The FTSE All-Share is widely regarded as the best performance measure of the overall UK stock market. It is used by investors and fund managers as a benchmark for the performance of diversified UK equity portfolios. The index provides a holistic view of market trends and economic health, encompassing the full spectrum of listed companies.

Comparing the Indices

Market Capitalization and Influence

- FTSE 100: Dominated by large-cap companies with significant market influence. These companies often have a global presence.

- FTSE 250: Comprised of mid-cap companies with a more domestic focus, providing insights into the UK economy.

- FTSE All-Share: Encompasses the entire market, offering a comprehensive view of the performance across all company sizes.

Sector Representation

Each index has a different sectoral composition, affecting their performance under various economic conditions:

- FTSE 100: Heavily weighted towards sectors like finance, energy, and consumer goods.

- FTSE 250: More balanced sector representation, with significant contributions from industrials, consumer services, and technology.

- FTSE All-Share: Broadest sector coverage, reflecting the diversity of the entire UK market.

Volatility and Risk

- FTSE 100: Generally less volatile due to the presence of large, established companies.

- FTSE 250: Higher volatility as mid-cap companies are more sensitive to economic changes and growth prospects.

- FTSE All-Share: Volatility reflects a mix of large, mid, and small-cap companies, offering a balanced risk profile.

Conclusion

The FTSE 100, FTSE 250, and FTSE All-Share indices are essential tools for understanding the UK stock market. Each index offers unique insights into different segments of the market, helping investors make informed decisions.

Leave a comment