The Consumer Price Index (CPI) is a crucial economic indicator that helps to measure the average change over time in the prices paid by consumers for a market basket of goods and services. This comprehensive guide will delve into how the CPI is calculated, what it measures, and why it is essential for understanding economic trends and making informed financial decisions.

Introduction to the CPI

What is the CPI?

The Consumer Price Index (CPI) is an index that measures the average change in prices over time that consumers pay for a basket of goods and services. It is a vital tool for gauging inflation and understanding the cost of living. By tracking changes in the CPI, economists, policymakers, businesses, and individuals can get a sense of how prices are changing in the economy.

Importance of the CPI

The CPI is used for various purposes, including:

- Measuring Inflation: It helps to monitor inflation levels by comparing the current prices of a basket of goods and services to those in a base period.

- Economic Policy: Policymakers use CPI data to make informed decisions about interest rates and other economic policies.

- Adjusting Income: Wages, pensions, and social security benefits are often adjusted based on changes in the CPI to maintain purchasing power.

- Business Planning: Businesses use CPI data to set prices, plan for cost increases, and make strategic decisions.

How the CPI is Calculated

Data Collection

The calculation of the CPI starts with the collection of price data for a fixed basket of goods and services. This data is gathered from various sources, including:

- Retail Outlets: Prices of goods and services are collected from a representative sample of retail outlets, including supermarkets, department stores, and specialty shops.

- Service Providers: Prices for services such as medical care, education, and transportation are collected from relevant service providers.

- Online Platforms: Increasingly, prices are also collected from online retailers to reflect modern shopping habits.

- Consumer Surveys: Data on spending patterns is collected through consumer surveys to determine the relative importance (weights) of different items in the CPI basket.

The CPI Basket

The CPI basket includes a wide range of goods and services that represent the typical consumption patterns of households. These items are categorised into several groups:

- Food and Beverages: Groceries, dining out, alcoholic and non-alcoholic beverages.

- Housing: Rent, utilities, home maintenance, and repairs.

- Apparel: Clothing, footwear, and accessories.

- Transportation: Vehicle purchase, fuel, public transportation.

- Medical Care: Health insurance, medical services, medications.

- Recreation: Entertainment, hobbies, and recreational activities.

- Education and Communication: Tuition fees, books, communication services.

- Other Goods and Services: Personal care products, insurance, and miscellaneous expenses.

Weighting of Items

Each item in the CPI basket is assigned a weight based on its relative importance in the average consumer’s budget. The weights are derived from detailed expenditure surveys, which determine how much of their total spending households allocate to each category. For example, housing typically has a higher weight than apparel because households spend a larger portion of their income on housing.

Price Collection and Index Calculation

Once the prices are collected, the CPI is calculated using the following steps:

- Price Collection: Prices for all items in the CPI basket are gathered periodically, usually monthly.

- Price Comparison: The current prices are compared to those in a base period (a reference period against which future prices are measured).

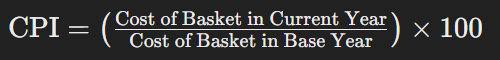

- Weighted Average Calculation: The weighted average of price changes for all items is computed. The formula used is:

- Index Calculation: The index is computed by comparing the current weighted average to the base period’s weighted average.

Seasonal Adjustment

Prices of certain items can fluctuate due to seasonal factors, such as holiday seasons or agricultural harvests. To provide a clearer picture of underlying inflation trends, the CPI may be seasonally adjusted. This involves removing the effects of seasonal variations to highlight the more consistent movements in prices.

What the CPI Measures

Inflation

The CPI is a primary measure of inflation, indicating the rate at which the general level of prices for goods and services is rising. By comparing the current CPI with the CPI from a previous period, economists can determine the inflation rate. For example, if the CPI increases by 2% from one year to the next, it suggests that the overall price level has risen by 2%.

Cost of Living

The CPI reflects changes in the cost of living by tracking how much more (or less) consumers need to spend to maintain a consistent standard of living. An increase in the CPI means that consumers are paying more for the same basket of goods and services, indicating a higher cost of living.

Purchasing Power

Changes in the CPI can affect purchasing power. If wages do not keep pace with increases in the CPI, the purchasing power of consumers declines, meaning they can buy less with the same amount of money. Conversely, if wages grow faster than the CPI, purchasing power increases.

Variations of the CPI

Core CPI

The Core CPI excludes volatile items such as food and energy prices, which can fluctuate widely due to factors like weather conditions and geopolitical events. By excluding these items, the Core CPI provides a clearer view of underlying inflation trends.

CPIH

CPIH is a variant of the CPI that includes owner-occupiers’ housing costs, providing a more comprehensive measure of the cost of living. This measure reflects the cost of owning, maintaining, and living in one’s own home, offering a broader perspective on inflation.

RPI

The Retail Price Index (RPI) is another measure of inflation used in the UK. While similar to the CPI, the RPI includes housing costs such as mortgage interest payments and council tax. The RPI is often used for indexation purposes, such as adjusting pensions and wages, but it is considered less accurate than the CPI.

Limitations of the CPI

Representation Issues

The CPI is designed to represent the average consumer, but individual spending patterns can vary widely. Different households may experience different rates of inflation depending on their specific consumption habits. For example, a household that spends a significant portion of its income on healthcare may experience higher inflation than one that spends more on technology.

Quality Adjustments

Changes in the quality of goods and services can affect the CPI. For instance, a new model of a smartphone may have more features than the previous model, which can complicate price comparisons. The CPI attempts to account for quality changes, but these adjustments can be challenging and sometimes subjective.

Substitution Bias

The CPI assumes a fixed basket of goods, which may not account for consumer substitution. When the price of an item rises significantly, consumers may switch to a cheaper alternative, but the CPI does not fully capture this behaviour. This can lead to an overestimation of the true increase in the cost of living.

Leave a comment